how to calculate taxes taken out of paycheck in illinois

Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools. How Your Paycheck Works.

Paycheck Tax Withholding Calculator For W 4 Tax Planning

It can also be used to help fill steps 3 and 4 of a W-4 form.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

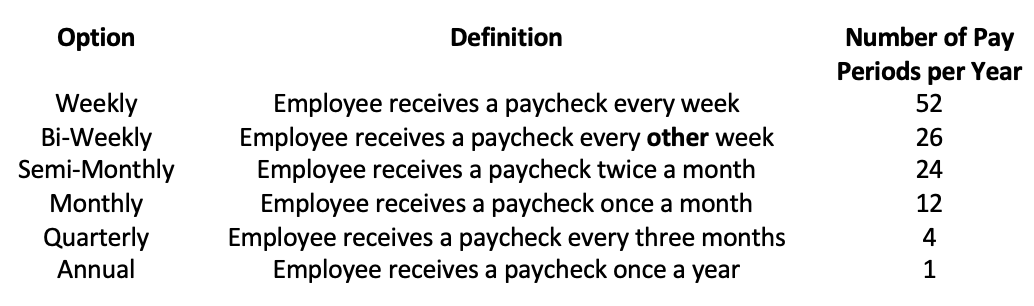

. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. This Illinois hourly paycheck calculator is perfect for those. This free easy to use payroll calculator will calculate your take home pay.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Use our 1040 income. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

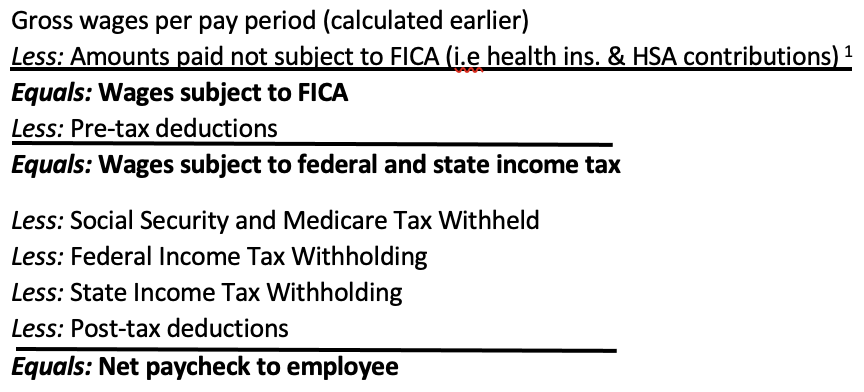

Once youve figured out the unemployment taxes youll need to report and pay your tax withholdings. For post-tax deductions you can choose to either take the standard deduction amount or itemize your deductions. Switch to Illinois hourly calculator.

The average tax rate for those in the lowest income tax bracket is 106 percent higher than each group between 10000 and. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings.

The average tax rate for taxpayers who earn over 1000000 is 331 percent. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. Youll use your employees IL-W-4.

Enter your income and other filing details to find out your tax burden for the year. Illinois Hourly Paycheck Calculator. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Use our income tax calculator to estimate how much youll owe in taxes. If your itemized deductions are less than the standard deduction just claim the standard amount.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. For those who make between 10000 and 20000 the average total tax rate is 04 percent. Each type of payroll tax uses a different form and is paid through a different system.

According to the Illinois Department of Revenue all incomes are created equal. Supports hourly salary income and multiple pay frequencies. No cities within Illinois charge any additional municipal income taxes so its pretty simple to calculate this part.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Make Your Payroll Effortless and Focus on What really Matters. Illinois Paycheck Calculator Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. If youve paid the state unemployment taxes you can take a credit of up to 54 on the federal calculation. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

Personal income tax in Illinois is a flat 495 for 20221. Adjusted gross income Post-tax deductions Exemptions Taxable income. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy.

Ad Compare Prices Find the Best Rates for Payroll Services. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Personal Income Tax in Illinois.

Illinois tax is calculated by identyfying your taxable income in illinois and then applying this against the personal income tax rates and thresholds identified in the illinois state tax tables see below for currect illinois state tax rates and historical illinois tax tables supported by the illinois state salary calculator. Calculates Federal FICA Medicare and withholding taxes for all 50 states. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. This calculator is intended for use by US.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Illinois Paycheck Calculator Smartasset

2022 2023 Tax Brackets Rates For Each Income Level

Paycheck Calculator Take Home Pay Calculator

Different Types Of Payroll Deductions Gusto

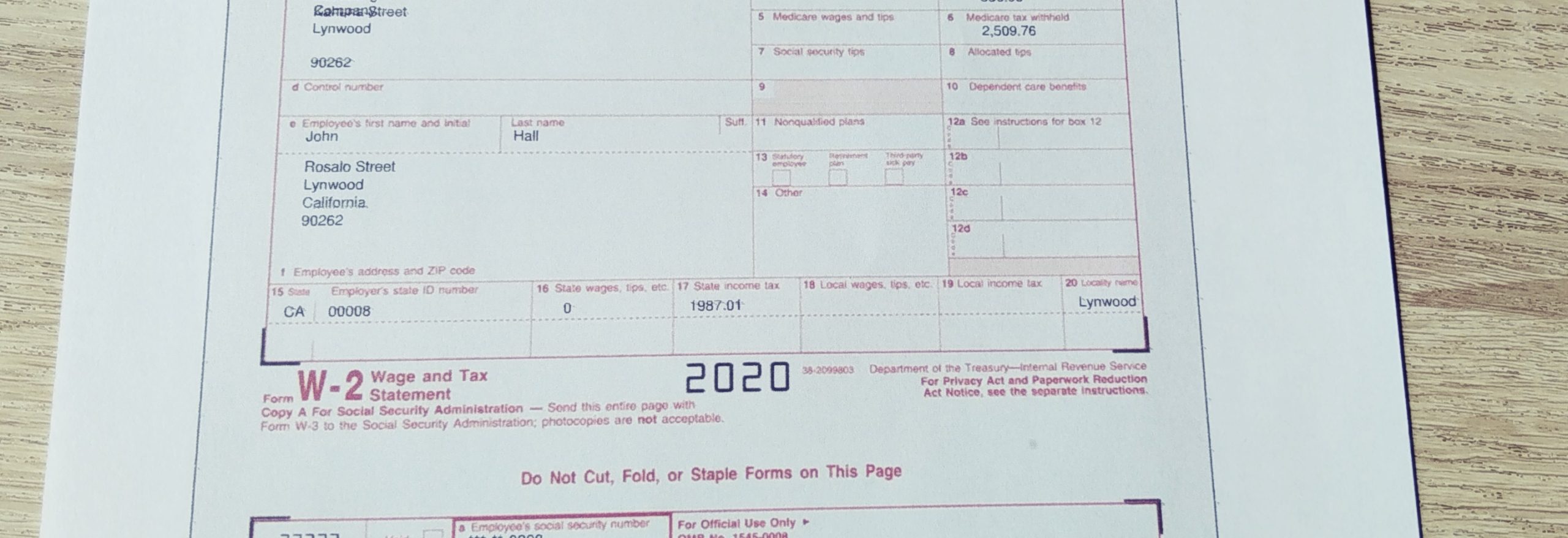

How To Calculate W2 Wages From Paystub Paystub Direct

Free Paycheck Calculator Hourly Salary Usa Dremployee

What Is The Take Home Salary For 100 000 In California Quora

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

What Are Marriage Penalties And Bonuses Tax Policy Center

Calculate An Employee S Final Paycheck Free Calculator Onpay

Understanding Your Pay Statement Office Of Human Resources

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

What You Need To Know About Hiring Workers Calculating A Paycheck Ilsoyadvisor

Free Online Paycheck Calculator Calculate Take Home Pay 2022

What You Need To Know About Hiring Workers Calculating A Paycheck Ilsoyadvisor

Paycheck Calculator Take Home Pay Calculator

What You Need To Know About Hiring Workers Calculating A Paycheck Ilsoyadvisor